SBA 2202 2015-2026 free printable template

Show details

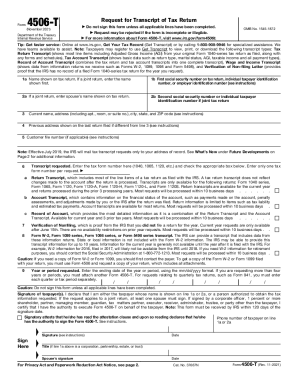

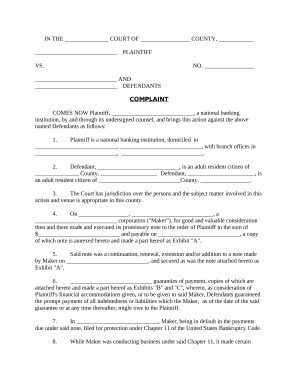

Applicant s Name SUGGESTED FORMAT SCHEDULE OF LIABILITIES Notes Mortgages and Accounts Payable Date of Schedule Name of Creditor Original amount date Current balance delinquent Maturity Payment Month- Year How Secured Signed Title SBA Form 2202 10-15 This form is provided for your convenience in responding to filing requirements in Item 2 on the application SBA Form 5. You may use your own form if you prefer. The information contained in this schedule is a supplement to your balance sheet and...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign sba form 2202 example filled out

Edit your schedule of liabilities form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sba form 2202 schedule of liabilities form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing schedule of liabilities sba online

To use our professional PDF editor, follow these steps:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit sba schedule of liabilities form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

The use of pdfFiller makes dealing with documents straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

SBA 2202 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out schedule of liabilities form

How to fill out SBA 2202

01

Gather your financial information related to your business.

02

Download the SBA Form 2202 from the SBA website.

03

Fill out the business information section, including the legal name and address.

04

Provide details of any outstanding loans or lines of credit.

05

Enter the relevant loan details, including loan amounts and balances.

06

Complete the sections regarding your business’s payroll costs and number of employees.

07

Review the form for accuracy and completeness.

08

Submit the form online or print and mail it as required.

Who needs SBA 2202?

01

Businesses that have taken out loans under the Paycheck Protection Program (PPP) or other SBA loan programs need to fill out SBA 2202.

02

Employers who are seeking forgiveness for their PPP loans must submit this form as part of their application.

03

Businesses needing to report their outstanding debt obligations also require SBA 2202.

Fill

sba debt schedule form

: Try Risk Free

People Also Ask about form 2202

What should be included in schedule of Liabilities?

Information that is needed for Schedule of Liabilities 1.Name of Creditor 2. Original amount due 3. Original date due 4. Current balance 5.

What are Liabilities for SBA?

A business's financial obligations—like SBA 7(a) loan payments, salaries, mortgages, and deferred payments—are considered liabilities. Liabilities are deducted from a business's total equity.

How to fill out a SBA form 2202?

3:21 4:19 So this was just one example on how to fill out a row for form 2202. First you put in the name ofMoreSo this was just one example on how to fill out a row for form 2202. First you put in the name of the creditor. The original amount that you owed and when this originated.

What should I put on my SBA 2202?

How to Fill out SBA Form 2202? First, the applicant has to provide their name and the date when the schedule is prepared. The first column requires the name of each creditor. The original amount due and the amount of money that has to be paid should be entered in the second column.

What should be included in SBA schedule of Liabilities?

Information that is needed for Schedule of Liabilities 1.Name of Creditor 2. Original amount due 3. Original date due 4. Current balance 5.

Is SBA form 2202 required?

Form 2202 must be completed on behalf of the subject business requesting the loan and all affiliate businesses. Affiliate businesses are defined by the SBA as any business owned 51% or more by a 20% or more owner of the subject business.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send the purpose of sba 2202 sba 2202 online with pdffiller to be eSigned by others?

To distribute your the purpose of sba form 2202 also known as the disaster loan eidl program, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How do I make edits in sba business debt schedule without leaving Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your sba debt schedule, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

Can I edit sba format on an Android device?

The pdfFiller app for Android allows you to edit PDF files like form 2202 financial report. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

What is SBA 2202?

SBA 2202 is a form used by the Small Business Administration (SBA) that collects information from borrowers regarding their loans under the Paycheck Protection Program (PPP).

Who is required to file SBA 2202?

All borrowers who received a PPP loan are required to file SBA 2202 to provide necessary information about their loan usage and eligibility.

How to fill out SBA 2202?

To fill out SBA 2202, borrowers must provide accurate information regarding their loan amount, the number of employees retained, and the specific use of the funds, following the instructions provided by the SBA.

What is the purpose of SBA 2202?

The purpose of SBA 2202 is to ensure compliance with the terms of the PPP loan, and to provide the SBA with the necessary information to track the usage of funds and assess eligibility for forgiveness.

What information must be reported on SBA 2202?

SBA 2202 must report information such as the loan amount, number of employees retained, wages paid, and how the funds were used, including expenses related to payroll, utilities, rent, and mortgage interest.

Fill out your SBA 2202 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

What Is A Schedule Of Liabilities is not the form you're looking for?Search for another form here.

Keywords relevant to schedule of liabilities sba example

Related to sba form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.